CMBS Market Commentary

CMBS loan pricing

Current new issue spreads in the CMBS market widened, while the rates rallied across the curve. Loan coupons generally fall between 3.50% and 4.00% on stabilized commercial real estate assets.

Market commentary

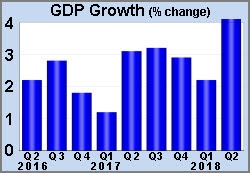

Markets had been moving along most of summer before getting jolted out of their vacation haze as the calendar turned to August. The US-China trade negotiations had continued to escalate first with the US imposing an additional 10% tariff on $300B of additional Chinese goods, which was later delayed to start December 1. China retaliated by halting imports of US crops and weakening the yuan. The back and forth cause rates to drop dramatically, volatility to spike and spread markets to widen. The rate curve has flattened significantly, raising recession concerns.

______________________________________________________________________________

Commercial Loans $4mm to $500mm Nationwide

Single Tenant Retail, Triple Net, 1031 Exchange, Hospitality (Hotel & Motel), Hotel Construction, Multi Family, Construction, Office (building, condo, complex), Leisure (golf course, marina, RV park, etc.), Residential N.O.O., SBA 504, SBA 7a, Warehouse, Mixed use, Storage.

Loans

Acquisition and development, First Mortgage & Mezzanine, Rate and term refinance, Cash Out, Bridge loans, Nonrecourse, Agency lending programs, Interest Only, Private money

Our CMBS loan terms include:

All major property types, $1 million – $500+ million, Non-recourse (subject to standard carve-outs), Up to 75% LTV, 5-, 7-, or 10-year terms, 25- to 30-year amortization, Fixed or floating rates, First mortgage and mezzanine loans

North Atlantic Mortgage Corp.

John Sauro, President

1-877-794-5363

________________________________________________________________

The S&P 500 and DJIA have pulled back from all-time highs but maintain year-to-date gains of 16.6% and 12.6%, respectively1. CMBS benchmark AAA bond spreads widened about 10-15 bps from tights in mid-July and now trade in the mid-high 90’s while some recent deals have touched 1001. All-in coupons on CMBS loans have stayed in the same place despite this bond spread widening due to the drop in rates.

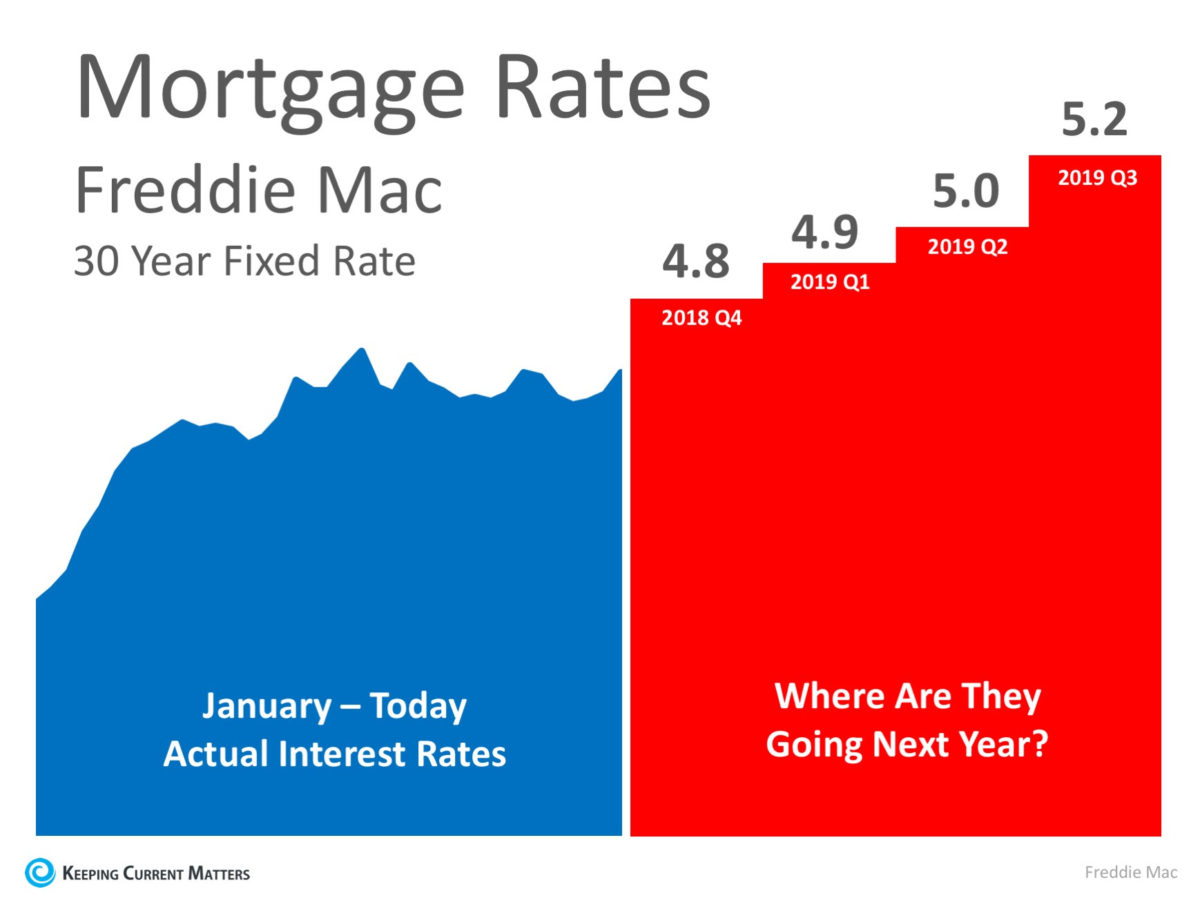

The Fed cut rates as expected at their July 31 meeting by a quarter point. This was widely expected by the market although some expected a half point cut. Following the announcement however, Fed Chairman Powell was more hawkish than some had expected, describing the cuts “as more of a mid-cycle adjustment than the beginning of a series of long term cuts.” The additional US tariffs on China and China’s retaliation have driven market expectations for a rate cut at the next meeting to at least another quarter point with a possibility of a half point. The next FOMC meeting will be on September 18.

Total 2019 year-to-date non-agency US CMBS issuance is $46.8 billion, comprised of $25.4 billion of conduit, $16.0 billion of floating rate single-asset/single-borrower, and $5.4 billion of fixed rate single-asset/single-borrower2. Issuance is down year over year but the recent drop in rates and loan coupons should help keep the new origination pipeline going into the fall and year end.